Apprentice Mortgages

Helping you buy your first home

We can help you onto the property ladder

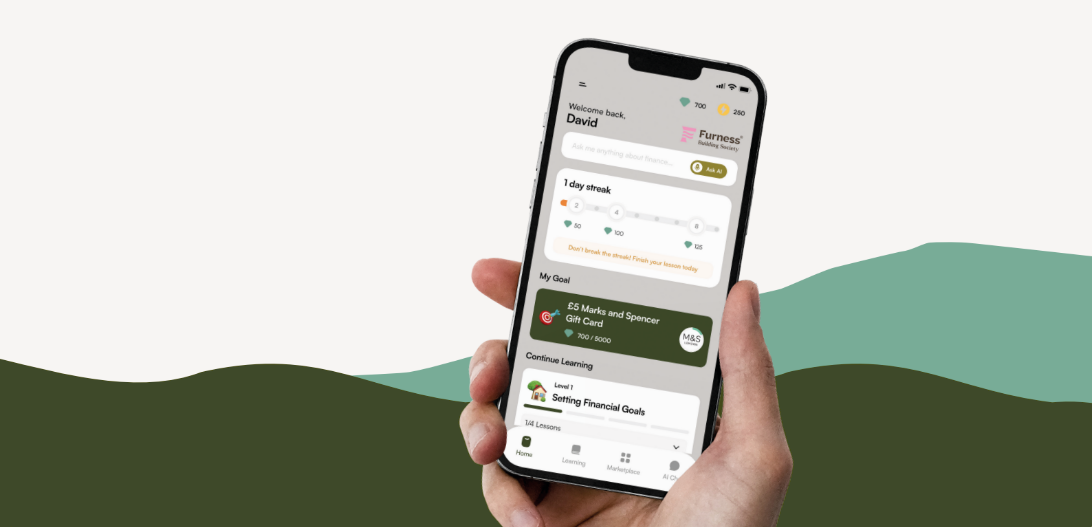

Our new digital savings experience is available now

Online - in App - In Branch

Savings Support Hub

Here you’ll find all money-saving advice and top tips to help you secure your financial future.

Keeping you and your finances safe from fraud

We have numerous topics we can share on keeping your finances safe from fraud.

Bank of England base rate decrease

The Bank of England announced on 18th December 2025 that it was decreasing its Base Rate from 4.00% to 3.75%. The Bank of England Base Rate is one of many factors which impact the interest rates we set on both our mortgage and savings accounts.

We are currently considering how this rate change will impact our variable rate mortgage and we will release more information as soon as we can.

Customers with fixed rate mortgage or savings accounts will not see any change in their interest rates and will not be affected by this Base Rate change.

Customers with tracker mortgages that are directly linked to the Bank of England Base Rate will see the interest rates on their mortgage accounts decrease by 0.25% in January 2026. We'll write to let you know what your new interest rate and monthly payments will be.

Looking for more information? Read our guide to the BOE base rate.

FSCS protection limit increased from 1 December 2025

We want to let you know that the Financial Services Compensation Scheme limit increased to £120,000 on 1 December 2025. This change will give savers even greater peace of mind and added protection for their money.

Your eligible savings with us will continue to be protected by the FSCS up to the new limit. You do not need to do anything and your cover has updated automatically.

If you would like more information about the FSCS and what the change means for you, please visit the FSCS website or contact our team who will be happy to help.

A society for future generations

We take great pride in our community and have been prioritising our customers' needs for over 150 years. From opening your first savings account to buying your first home, we’re here to help you reach every milestone.

As a Furness member, you can enjoy a brighter financial future for you and your family. Together, we hope to build an even better building society for future generations. In exchange for your support, our promise to you is a supportive, secure, and accessible service, with our teams available online, in branch and over the phone.

"Best Building Society for Customer Service"

The Personal Finance Awards 2025

News and articles

The importance of diversifying your savings

In this article we’ll explain all about diversification and the benefits of opening multiple savings accounts.

A guide to remortgaging

Here's our guide to help you know what to do when your mortgage term ends.

Stamp Duty changes in 2025

Here’s everything you need to know about the Stamp Duty Land Tax rate change.

Contact Us

Branch finder

Visit one of our branches in the North West

Member Support

Or see all the ways you can contact us, online or via post